fulton county ga property tax sales

Ad Find Fulton Online Property Taxes Info From 2022. This is the total of state and county sales tax rates.

110 E Main St Manchester Ga 31816 Little Dream Home Old Houses Vintage Hardwood Flooring

Sales Use Taxes Fees Excise Taxes SAVE - Citizenship Verification.

. For Fulton County taxes youll need to contact the Fulton County Tax Commissioners Office at 404-730-4000. There is a 3 service fee for all payments made by credit card. Fulton County GA currently has 3707 tax liens available as of August 12.

The latest sales tax rate for Fulton County GA. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Fulton County GA at tax lien auctions or online distressed asset sales. County Property Tax Facts Fulton On this page.

235 Peachtree Center North Tower. What is the sales tax rate in Fulton County. There is a 175 service charge for all e-checks.

The Georgia state sales tax rate is currently. The 2018 United States Supreme Court decision in South Dakota v. This rate includes any state county city and local sales taxes.

Fulton County collects on average 108 of a propertys assessed fair market value as property tax. The one with the highest sales tax rate is 30301 and the one with the lowest sales tax rate is 30339. 2020 rates included for use while preparing your income tax deduction.

In such case the Board of Assessors will notify each taxpayer of its decision to utilize the additional time. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day. 141 Pryor Street SW.

2020 rates included for use while preparing your income tax deduction. The minimum combined 2022 sales tax rate for Fulton County Georgia is. Fultons rate inside Atlanta is 3.

The Fulton County sales tax rate is. The median property tax in Fulton County Georgia is 2733 per year for a home worth the median value of 253100. Fulton County Tax Commissioner Dr.

If you need reasonable accommodations due to a disability including communications in an alternative format please contact the Disability Compliance Liaison at 404612-9166. The most populous zip code in Fulton County Georgia is 30349. Please submit no faxesemails the required documentation for review to the following address below.

The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. 48-5-311 e 3 B to review the appeal of assessments of property value or exemption denials. The Fulton County Sheriffs Office month of November 2019 tax sales.

Due to renovations at the Fulton County Courthouse. Just Enter an Address. Documents necessary to claim excess funds in Fulton County below are the instructions on submissions.

Tax Commissioner Arthur E Ferdinand 141 Pryor Street SW Suite 1085 Atlanta GA 30303 Phone. Your Search for Real Updated Property Records Just Got Easier. County city and local sales taxes.

Ad Buy HUD Homes and Save Up to 50. The Fulton County Board of Assessors reserves the right when circumstances warrant to take an additional 180 days pursuant to OCGA. Fulton County has one of the highest median property taxes in the United States and is ranked 220th of the 3143 counties in order of median property taxes.

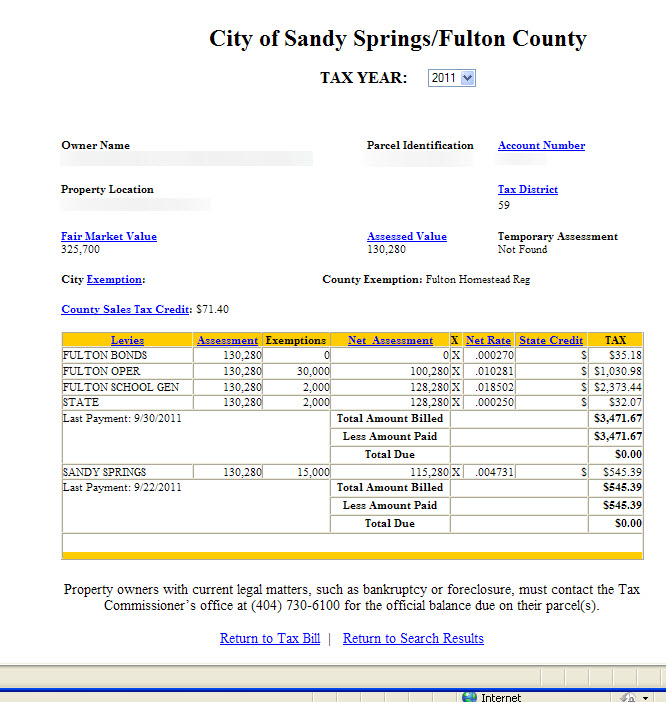

Each of the 18 taxing jurisdictions in Fulton County including cities school boards and Fulton County Government will also set their annual millage rate in coming months. OFfice of the Tax Commissioner. The Fulton County Tax Commissioner is responsible for the collection of Property Taxes for Fulton County government Fulton County and City of Atlanta Schools the State of Georgia and the cities of Atlanta Mountain Park Sandy Springs Johns Creek and Chattahoochee Hills.

A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER. Please type the text you see in the image into the text box and submit. Ferdinand is elected by the voters of Fulton County.

Residents may also pay their taxes in-person at City Hall located at 2006 Heritage Walk Milton GA 30004. Tax Sales-Excess Funds Procedure Application. For TDDTTY or Georgia Relay Access.

SUT-2017-01 New Local Taxes 13182 KB. Sales Tax Bulletin - New Atlanta and Fulton County Sales Taxes. Register for 1 to See All Listsings Online.

Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am. 185 Central Ave 9th Floor. These buyers bid for an interest rate on the taxes owed and the right to collect.

The Fulton County Sales Tax is collected by the merchant on all qualifying sales made within. Email the Board of Assessors. Fulton County Sheriffs Office.

As far as all cities towns and locations go the place with the highest sales tax rate is Atlanta and the place with the lowest sales tax rate is Alpharetta. Find HUD Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More.

Tax Parcels Fulton County Georgia Open Data

Happening In Fulton Property Tax Bills Due

Sandy Springs Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Press Release Announcing A Proposed Property Tax Increase

Fulton County Ga Hallock Law Llc Property Tax Appeals

Fulton County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Fulton County Georgia Property Tax Calculator Unincorporated Millage Rate Homestead Exemptions

Tax Sale Listing Dekalb Tax Commissioner

Georgia Relocation Guide Relocation Real Estate House Hunting

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Eastman Ga Dodge County Old House Photograph Copyright Brian Brown Vanishing South Georgia Usa 2015 Old Farm Houses Colonial Revival House Colonial Revival

Fulton County Property Owners Will Receive 2022 Notices Of Assessment

Redeem A Non Judicial Tax Deed Gomez Golomb Law Office

Frequently Asked Questions Faq About Georgia Property Tax Appeals Hallock Law Llc Property Tax Appeals